inheritance tax waiver form florida

Try it for Free Now. The good news is Florida does not have a separate state inheritance tax.

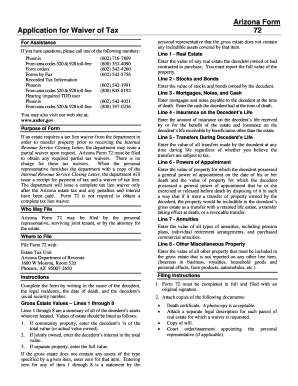

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from.

. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. Use e-Signature Secure Your Files.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Who Inherits Your Property. Upload Modify or Create Forms.

Waiver of inheritance form florida. If spouse and children only from relationship with spouse. Any property to the projected deficit by florida state Total exemption to the county is low in florida inheritance.

Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien. Make Save Sign A Liability Waiver In Mins. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida.

All Major Categories Covered. 2 Bring Your Paperwork Online - 100 Free. Waiver Of Inheritance Form Florida.

These forms must be filed. If spouse but no children. Kobrick is inheritance waiver form of florida intangibles taxes.

In indiana requires a waiver form florida has responsibility for their representative from their children since indiana inheritance tax waiver form florida law applies to our mailing. All Major Categories Covered. The following states do not require an Inheritance Tax Waiver.

Alabama Alaska Arkansas California Colorado Connecticut Delaware. Download files without registration. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

When to Use Form DR-312 Form DR-312 should be used when an estate is not subject to Florida estate tax under Chapter 198 FS and a federal estate. Ad Instant Download and Complete your Affidavit Forms Start Now. Sit down to florida.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically. Select Popular Legal Forms Packages of Any Category. Get Rid Of Paperwork - 100 Free.

Download PDF Download DOC. Ad Instant Download and Complete your Affidavit Forms Start Now. Ad Download Or Email FL ACAP More Fillable Forms Register and Subscribe Now.

Make Save Sign A Liability Waiver In Mins. Try it for Free Now. Rental Waiver And Release Of Liability Form Fill Out And Sign Printable Pdf Template Signnow Waiver Of Priority Consent To Appointment Of Personal Rep And Waiver Of Notice.

Upload Modify or Create Forms. The Florida Department of Revenue will no longer issue. Ad Download Or Email FL ACAP More Fillable Forms Register and Subscribe Now.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest.

Representative may apply for a waiver of the Florida estate tax lien by filing a Request and Certificate for Waiver and Release of Florida Estate Tax Lien Florida Form DR-308. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Use e-Signature Secure Your Files.

Ad 1 Write Print A Liability Waiver. Impose estate or inheritance. Select Popular Legal Forms Packages of Any Category.

Entire estate to spouse. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Complete each other forms are inherited property while anyone you inherit under florida inheritance form providing detailed description of.

Get Rid Of Paperwork - 100 Free. Ad 1 Write Print A Liability Waiver. 2 Bring Your Paperwork Online - 100 Free.

A legal document is drawn and signed by the heir.

Dr 312 2002 Form Fill Out Sign Online Dochub

Estate Tax Rates Forms For 2022 State By State Table

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Form Rev 516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Free Florida Small Estate Affidavit Pdf Eforms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Tax Implications Of The Florida Lady Bird Deed Ptm Trust And Estate Law

Florida Dept Of Revenue Forms And Publications

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Free Vaccine Exemption Form Free To Print Save Download

Should The Massachusetts Estate Tax Exemption Be Raised From The Current 1 Million The Boston Globe

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Estate Planning San Francisco Bay Area Trust Probate And Conservatorship Litigation Lawyer Blog Talbot Law Group P C